Introduction to Bill Trackers

Bill tracker apps have become indispensable tools for managing personal finances. These apps streamline the process of tracking expenses, managing budgets, and organizing financial information. They offer various functionalities, from basic expense tracking to complex invoice management, catering to diverse financial needs.

Types of Bill Trackers

Bill trackers come in different forms, each tailored to specific financial management needs. Some are primarily focused on budgeting, enabling users to meticulously plan their income and expenses. Others specialize in expense tracking, providing a detailed record of all transactions. There are also invoice management apps designed to handle professional or business-related financial documents.

Common Features

- Expense Tracking: Recording transactions, categorizing expenses, and generating reports.

- Budgeting Tools: Setting financial goals, tracking progress towards them, and identifying areas for improvement.

- Invoice Management: Storing, organizing, and managing invoices, including reminders and payment tracking.

- Payment Reminders: Setting alerts and reminders for upcoming bill payments.

- Reporting: Generating financial reports and insights into spending patterns.

Benefits of Using a Bill Tracker

Employing a bill tracker app offers numerous advantages for managing personal finances. It promotes organization by centralizing all financial information in one place, making it easy to review and analyze spending habits. Staying on top of finances becomes more manageable with automated reminders and notifications, reducing the risk of late payments and associated fees. These tools also aid in developing sound financial habits and identifying areas where spending can be optimized.

Organization and Financial Management

Bill trackers are designed to empower users to maintain financial order. Their ability to categorize expenses and generate insightful reports allows users to identify spending patterns and make informed decisions about their money. Users can stay ahead of their finances with the assistance of reminders and automated payment schedules, preventing late payments and associated penalties. This proactive approach to finance contributes to overall financial stability and informed decision-making.

Key Features and Comparisons

Top 5 Important Features

- Expense Tracking: Detailed categorization and reporting.

- Budgeting Tools: Flexible budgeting options and goal setting.

- Payment Reminders: Automated notifications for timely payments.

- Reporting & Analysis: Comprehensive financial insights and visualizations.

- Security & Privacy: Robust measures to protect user data.

App Comparisons

| App Name | Pricing | Key Features | User Interface |

|---|---|---|---|

| App A | Free/Paid | Detailed Expense Tracking, Budgeting Tools, Notifications | Intuitive, Modern |

| App B | Free/Paid | Invoice Management, Payment Reminders, Reporting | Simple, Straightforward |

| App C | Free | Basic Expense Tracking, Budgeting, Simple Reporting | User-friendly, Easy to Navigate |

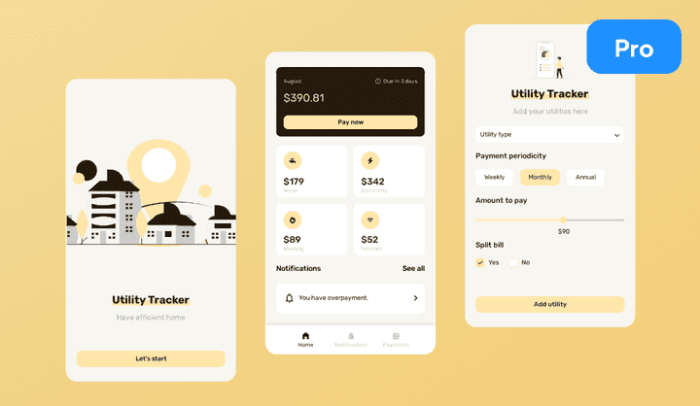

User Experience and Interface Design

User Flow Diagram

A typical user flow starts with account setup, followed by bill entry and categorization, then budget creation, and finally, reviewing reports and making adjustments.

User Interface Design Elements

- Color Palettes: Use a visually appealing color scheme that complements the app’s overall functionality.

- Typography: Choose fonts that are easy to read and enhance the app’s aesthetics.

- Intuitive Input: Design input fields that are user-friendly and easy to use.

User Roles and Features

| User Role | Primary Tasks | Access to Features |

|---|---|---|

| Individual User | Track expenses, budget, create reports | Full access to features |

| Family/Household User | Shared budgeting, family expenses | Limited access, shared features |

Integration with Other Financial Tools

Bill tracker apps can seamlessly integrate with bank accounts and credit cards to automatically import transaction data. This automation saves time and effort while ensuring data accuracy. API integrations enable this connection, offering a unified financial overview. Challenges in integration often stem from compatibility issues between different financial platforms. However, these can be addressed with careful API design and testing.

Mobile App Design Considerations

Mobile app design for bill trackers necessitates a responsive design to ensure optimal usability across various screen sizes. Performance optimization is crucial for a smooth user experience on different devices. Accessibility features should be included to cater to users with diverse needs. Clear and concise notifications are essential for timely reminders and updates.

Bill Tracking Strategies

Effective bill payment scheduling involves creating a calendar or using automated reminders to avoid late fees. Budgeting methods like zero-based budgeting or envelope budgeting can help manage bills efficiently. Automating payments and tracking upcoming due dates are crucial for maintaining financial stability.

Illustrative Examples

A user’s monthly bill payment schedule could include rent on the 1st, utilities on the 15th, and credit card payments on the 25th. A bill tracker app allows users to visualize this schedule and track their progress. Managing multiple accounts is simplified by the app’s ability to categorize and track payments for various accounts. The dashboard should display a summary of upcoming bills, pending payments, and overall financial health. A visual representation of bill payment history is a useful tool to monitor spending patterns and identify areas for optimization.

Last Point

In conclusion, choosing the best bill tracker app is a crucial step towards effective personal finance management. By understanding the key features, comparing different options, and considering your individual needs, you can find a solution that seamlessly integrates into your life, helping you stay organized, informed, and on top of your financial responsibilities. Ultimately, the right app empowers you to take control of your finances, fostering greater financial stability and peace of mind.